Can You Lose Money in Mutual Funds and SIPs? Understanding the Probability Over the Long Term in India

Investing in mutual funds and Systematic Investment Plans (SIPs) is one of the best ways for retail investors in India to grow wealth, especially when aiming for long-term financial goals. However, a common question for beginners is:

What are the chances of actually losing money in mutual funds or SIPs in India?

The answer depends largely on the investment horizon. While losses can occur in the short term, with disciplined SIP investing and long-term mutual fund holdings, the risk of losses falls drastically. Over longer periods, especially beyond 5 years, the probability of losing money becomes practically zero in the Indian market context.

Probability of Losing Money in Mutual Funds and SIPs becomes as low as zero if you invest for long term. according to the reports the risk comes as close to zero percent after a certain time for the investment.

How Does Risk Change in Mutual Funds Over Time?

Diversification advantage in India: Mutual funds invest in many stocks and bonds across sectors, reducing the risk compared to investing in single stocks.

Short-term (1–5 years): Losses can happen due to market volatility. But in India’s mutual fund market, the chance of loss reduces significantly after 5 years.

Medium-term (around 10 years): Studies in India show that over a 10-year period, returns are positive in nearly 90%+ of cases. The probability of loss is almost negligible.

Long-term (30+ years): Although theoretically possible, losing money over 30+ years in Indian mutual funds is practically non-existent due to market growth and diversification.

Why Does Loss Probability Become Zero in SIPs?

SIPs, which encourage regular investing over time, use rupee cost averaging to smooth out market fluctuations. This lowers the risk of investing at a bad time.

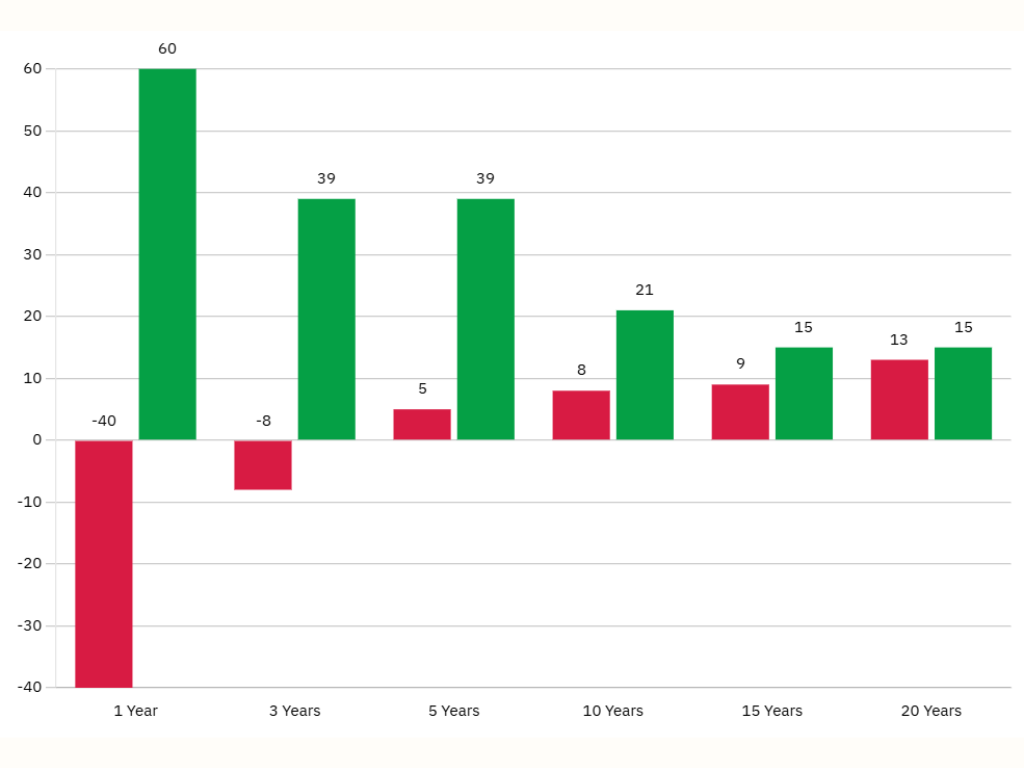

1–3 years: SIP returns can be volatile with outcomes ranging from +60% to -40%, showing risk in the short run.

5 years: The turning point. Historical data in India shows no 5-year SIP has ever recorded negative returns. The worst returns observed are still positive (+5%).

10–20 years: SIP returns are very stable, with annualized returns between 8% and 15%, making the chance of financial loss virtually zero.

Beyond 20 years: SIPs consistently generate positive returns comfortably above inflation — the loss probability for SIPs held this long is 0%.

This pattern confirms that SIPs are one of the most reliable investment tools for long-term financial security in India.

SIPs vs Fixed Deposits (FDs) in India: Which Is Safer?

Fixed deposits feel safe because they guarantee principal, but only up to ₹5 lakh per depositor per bank under the Indian Deposit Insurance and Credit Guarantee Corporation (DICGC) scheme. Amounts exceeding this insured limit carry some risk if the bank fails.

FD interest rates in India typically range between 5% and 7%, often just about beating inflation.

SIPs have no insurance limits but come with market risk in the short term. However, after 5+ years, losses have historically not occurred, and SIPs generate long-term wealth far exceeding FD returns.

Key Takeaways for Indian Investors

Short-term investments (1–3 years) in mutual funds or SIPs carry risk of negative returns.

Long-term investing (5+ years) in SIPs shows historically zero probability of loss.

10–20 year SIPs produce very stable, inflation-beating returns.

Diversified mutual funds help protect capital from total loss.

FDs are insured only up to ₹5 lakh per bank, unlike SIPs which have no such caps.

Final Thoughts

No investment is completely risk-free, but rigorous data and expert insights in India show that SIPs in diversified mutual funds held for 5 to 20 years or more are practically zero-risk in terms of losing money. Instead, they offer long-term capital appreciation and inflation protection.

For patient, disciplined investors in India, SIPs are among the safest and most effective wealth-building strategies available.

Start your Investment journey now with FUNDSCART.

Frequently Asked Questions (FAQs) about SIPs and Mutual Funds in India

Q1: Can SIPs in India lose money?

A1: Short-term SIP investments can be volatile, but no 5-year SIP has ever recorded a loss historically in India.

Q2: Are SIPs completely safe in India?

A2: While SIPs involve market risk, the probability of financial loss over long durations (5+ years) is practically zero.

Q3: How do SIPs compare with Fixed Deposits in India?

A3: Fixed Deposits are insured up to ₹5 lakh per bank but offer lower returns. SIPs have no insurance cap but outperform FDs in wealth creation over the long term with negligible loss risk beyond 5 years.

Mutual Funds are Subject to market risks, Read all scheme related documents carefully.