Gold and Silver Correlation: What Investors Need to Know

Introduction

In 2025, gold and silver have experienced a remarkable surge in prices and investment inflows, capturing widespread attention. Both metals are known as “safe haven” assets, valued for their ability to preserve wealth during economic uncertainty. This article aims to explain the unique dynamics that cause gold and silver prices to often move in tandem, explore their historic behavior, and understand the market factors driving their recent sharp rises.

The Relationship Between Gold and Silver Prices

Gold and silver have historically exhibited positive price correlation, meaning they often rise and fall together, although the degree of this relationship changes over time. From 2015 to 2025, this correlation has become stronger as both metals benefited from similar market forces, particularly safe haven demand and the growing popularity of exchange-traded funds (ETFs).

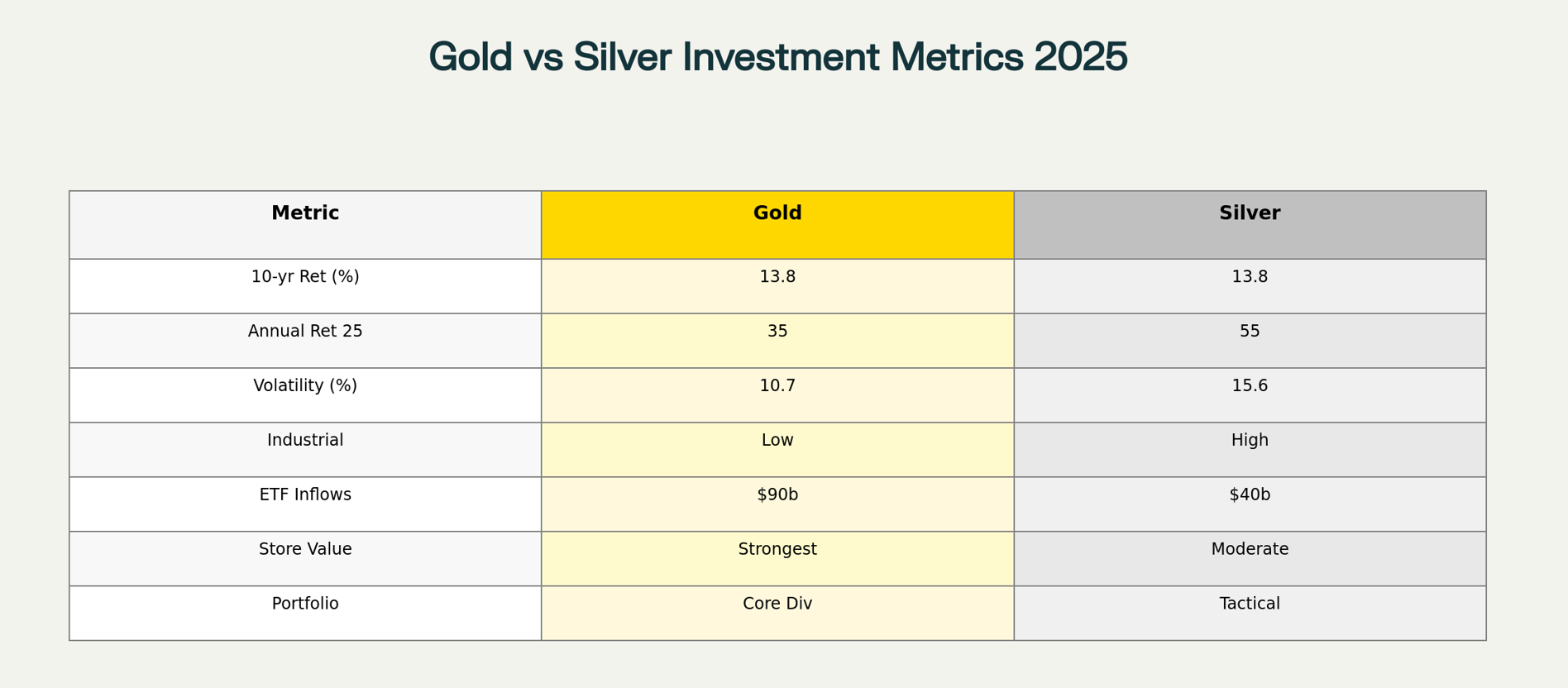

However, gold and silver do not move perfectly in lockstep. Gold is primarily valued as a store of value and a hedge against inflation and geopolitical risks. Silver, on the other hand, combines these characteristics with substantial industrial demand. This dual role causes silver’s price to show higher volatility and more exaggerated price swings during bull and bear phases.

Historic Growth Patterns and Volatility

Throughout history, gold has demonstrated consistent long-term growth, especially during periods of economic turmoil such as the 2008 financial crisis and the COVID-19 pandemic in 2020. Its reputation as a steady store of value has earned it trust among investors worldwide.

Silver, while following gold’s general trend, tends to amplify moves due to its smaller market size and industrial applications. In 2025, silver’s price gains outpaced gold’s, rising about 55% year-to-date compared to gold’s 35% increase. Such outperformance of silver during strong bull markets is typical, offering investors higher returns but also subjecting them to larger price corrections.

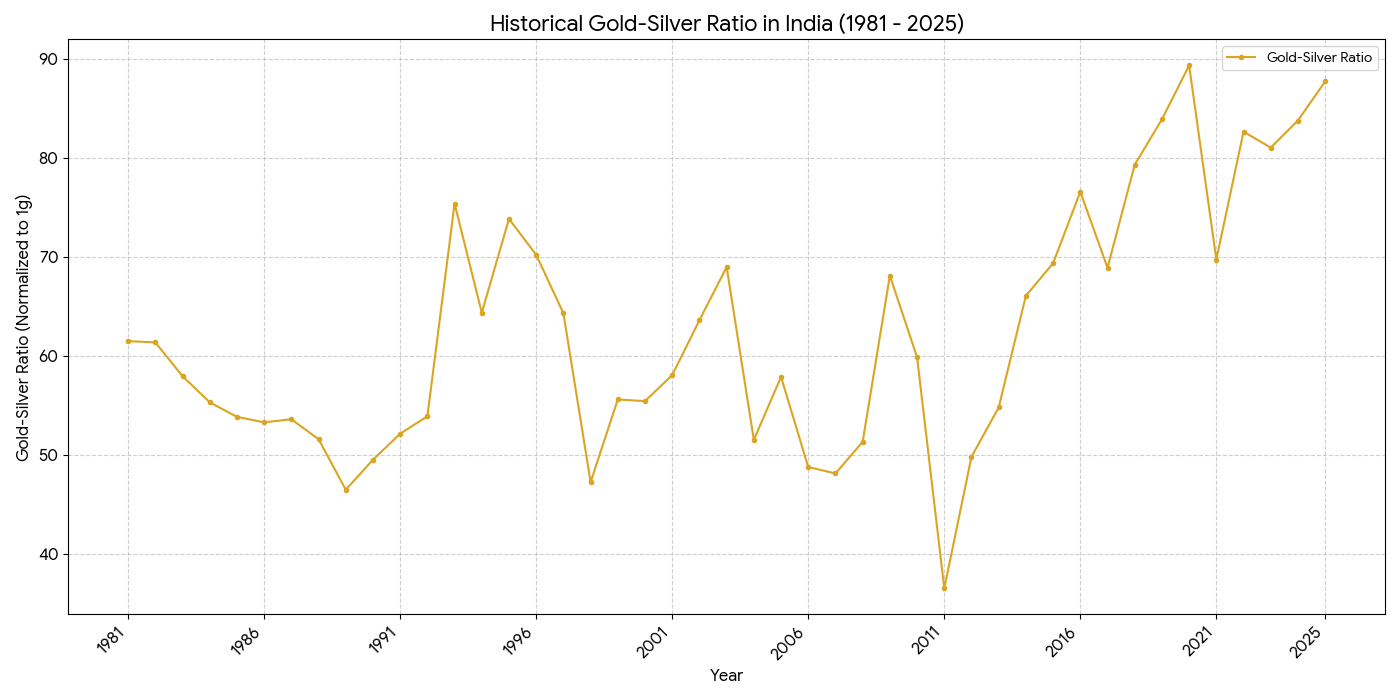

The single most important chart is the Gold-to-Silver Ratio (GSR), calculated by dividing the gold price by the silver price. It tells you the relative value between the two metals.

A High Ratio (e.g., currently above 80:1) means Silver is cheap compared to gold. This suggests a potential opportunity to Buy Silver, anticipating the ratio will eventually fall back to its historical average (60:1 to 70:1), leading to greater percentage gains in silver.

A Low Ratio (e.g., below 50:1) means Gold is cheap compared to silver, suggesting you should Buy Gold.

The Decision Based on Role:

If your goal is Wealth Preservation & Stability: Choose Gold. It is the non-volatile, safe-haven asset preferred during crises, acting as a direct hedge against inflation and economic uncertainty.

If your goal is Growth & Speculation: Choose Silver. It is a dual-role asset (part monetary, part industrial) that is significantly more volatile. It offers higher potential returns, especially during periods of strong global economic expansion due to its demand in technology and green energy.

The choice is a balance between the stability of gold and the growth potential of silver, guided by the relative cheapness indicated by the GSR.

Market Drivers Behind the 2025 Rally

Several key factors have contributed to the 2025 rally in gold and silver prices:

Safe Haven Demand: Investors flock to precious metals during times of geopolitical tension, economic uncertainty, or inflation fears. These conditions prevailed through 2025, driving strong demand.

ETF Inflows: Exchange-traded funds focused on gold and silver attracted massive inflows in 2025, pushing prices higher. Gold ETFs’ assets under management (AUM) nearly doubled year-over-year, while silver ETFs also saw record investments.

Monetary Policies: A weaker US dollar and anticipations of central bank interest rate cuts made non-yielding assets like gold and silver more attractive to investors.

Industrial Demand (Silver): Silver’s usage in technology, electronics, and renewable energy sectors adds cyclical ups and downs to its price, unlike gold’s relatively stable demand.

The Gold-to-Silver Price Ratio: Understanding Proportion

Investors often track the gold-to-silver price ratio, which indicates how many ounces of silver equal one ounce of gold. Historically, this ratio fluctuates widely and serves as a gauge for relative value between the two metals.

A rising ratio suggests silver is undervalued compared to gold, potentially signaling buying opportunities in silver. In contrast, a declining ratio indicates silver outperforming gold. In 2025, this ratio has seen shifts aligned with the strong bull markets in both metals but with silver showing sharper relative gains.

Portfolio Roles: Complementary But Different

Gold is widely regarded as a foundational asset for wealth preservation and portfolio diversification. Its relatively lower volatility makes it suitable for risk-averse investors seeking stability during market turmoil.

Silver, conversely, plays a more tactical investment role. Its higher volatility and industrial link allow investors to capture amplified gains in bull markets but also expose them to sharper risks. Using silver judiciously alongside gold can provide enhanced returns without sacrificing diversification benefits.

Why Gold Holds a Unique Position in Global Finance

Gold has long maintained a prominent role in the global economy. A key reason is that central banks and governments worldwide hold significant gold reserves as part of their financial strategy. Gold serves as a trusted asset that helps stabilize a country’s currency and economy during periods of uncertainty, giving it a level of reliability unmatched by most other investments. As a result, gold is widely regarded as a universal store of value—an asset that retains its worth over time, regardless of market fluctuations.

Silver, in contrast, is not held in official reserves. Its primary use is industrial, spanning sectors such as technology, electronics, and renewable energy. While silver can offer attractive returns during periods of strong market performance, it does not provide the same long-term security and stability that gold offers.

This distinction is why gold is often considered an everlasting investment, a foundational asset for preserving wealth and protecting value across generations.

Conclusion

The rally in gold and silver prices and investment inflows in 2025 exemplifies their continued relevance as safe haven assets amid global uncertainty. Understanding their intertwined but distinct behaviors—the steady strength of gold and the opportunistic volatility of silver—empowers investors to make informed decisions on portfolio construction and risk management.

By appreciating how economic factors, investor sentiment, and industrial usage shape precious metal markets, individuals can better navigate these dynamic commodities and harness their unique roles in safeguarding and growing wealth.

Start your investing journey now with Fundscart.

Follow us on Linkedin:- https://www.linkedin.com/company/fundscart/