Gold vs Real Estate vs Equity: Which Asset Class Builds Wealth Smarter?

Introduction: Why the Comparison Matters for Wealth Building

When it comes to wealth creation and asset allocation, investors frequently find themselves asking: “Should I buy gold, invest in equities, or put money in real estate?” This fundamental question about investment strategies has puzzled both new and seasoned investors for decades.

Each asset class offers unique strengths, distinct risks, and varying ideal time horizons that can significantly impact your portfolio performance.

The challenge lies not in identifying a single “best” investment option, but rather in understanding how gold investment, real estate investment, and equity investment complement each other in a well-diversified portfolio. The right choice depends entirely on your financial goals, liquidity requirements, and risk tolerance.

Smart wealth building requires understanding these nuances to make informed decisions about asset allocation.

Gold Investment: The Ultimate Stability and Hedge

Gold investment has served as humanity’s trusted store of value for millennia, and modern investors continue to rely on this precious metal for portfolio diversification. Gold acts as a powerful hedge against inflation and currency depreciation, making it an essential component of defensive investment strategies.

During times of economic uncertainty, geopolitical crises, or market volatility, gold prices typically demonstrate resilience while other asset classes may struggle. This precious metal offers exceptional liquidity, allowing investors to quickly convert their holdings to cash when needed.

However, gold investment comes with notable limitations—it generates no passive income, dividends, or rental yields.

Best For: Portfolio diversification, risk hedging, and wealth preservation during uncertain times.

Drawbacks: Price volatility can be significant in short-term periods, gold produces no yield or income, and physical gold storage presents security and tax complications for investors.

Real Estate Investment: Tangible Assets for Generational Wealth

Real estate investment stands out among asset classes for providing dual benefits: substantial capital appreciation combined with steady rental income. This tangible asset serves as an effective hedge against inflation over long-term investment cycles, making it particularly attractive for wealth building strategies focused on generational transfer.

Property investment offers investors the unique advantage of controlling a physical asset that can be improved, leveraged, and passed down through families. However, real estate investment requires significant initial capital, involves high transaction costs, and presents challenges with liquidity when quick access to funds becomes necessary.

Best For: Long-term wealth storage, legacy planning, and consistent income generation through rental properties.

Drawbacks: Illiquidity makes quick exits difficult, ongoing maintenance costs reduce returns, and regulatory changes can impact property investment profitability significantly.

Equity Investment: The Growth Engine for Wealth Creation

Equity investment has historically proven to be the highest-returning asset class over extended periods, making it the cornerstone of aggressive wealth creation strategies. Stock market investments benefit from powerful compounding returns and economic growth, allowing investors to participate in corporate success stories and innovation.

The stock market offers unmatched liquidity and scalability, enabling investors to start with modest amounts through mutual funds, SIP investments, and diversified equity portfolios. Modern technology has made equity investment more accessible than ever, with various investment strategies available to suit different risk profiles and financial goals.

Best For: Long-term investors seeking maximum wealth creation, portfolio growth, and participation in economic expansion.

Drawbacks: High volatility requires strong risk tolerance and discipline, short-term fluctuations can be emotionally challenging, and successful equity investment demands patience and conviction during market downturns.

Comparative Analysis: Asset Class Performance and Characteristics

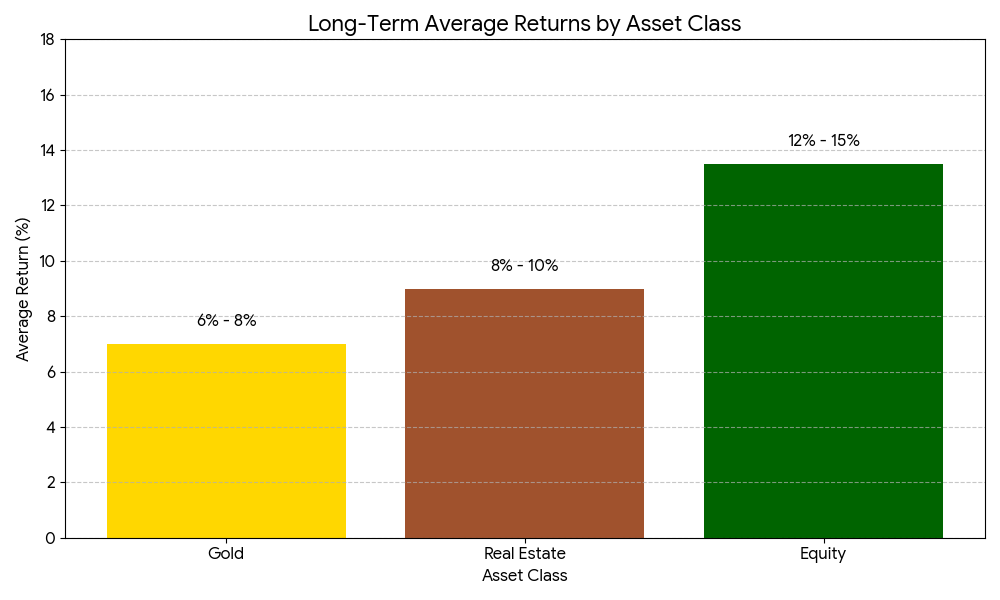

| Asset Class | Returns (Long-term Avg) | Liquidity | Risk Level | Income Potential | Best For |

|---|---|---|---|---|---|

| Gold | 6–8% | High | Medium | None | Hedging & diversification |

| Real Estate | 8–10% (varies by location) | Low | Medium | Rental income | Legacy & stability |

| Equity | 12–15% | High | High | Dividends | Wealth creation & growth |

This asset allocation comparison reveals that each investment option serves distinct purposes in a comprehensive wealth building strategy. Gold investment provides stability and hedging capabilities, real estate investment offers income and tangible value, while equity investment drives long-term portfolio growth through superior returns.

Understanding these asset class characteristics helps investors make informed decisions about portfolio diversification and investment strategies that align with their financial objectives and risk tolerance levels.

Strategic Portfolio Approach: Balanced Wealth Building

Rather than seeking a single winner among these asset classes, successful wealth creation requires recognizing that each investment type plays a crucial role in a well-constructed portfolio. The most effective investment strategies typically incorporate elements from all three categories.

A prudent asset allocation strategy might include gold investment comprising 5–10% of the portfolio for diversification and risk hedging.

The Real estate investment can provide stability and income generation, while equity investment should form the growth foundation, potentially representing 40–60% of total investments for long-term wealth building.

This balanced approach to portfolio diversification helps investors weather various market conditions while maximizing wealth creation potential. Asset allocation percentages should be adjusted based on individual circumstances, age, risk tolerance, and specific financial goals.

Building Wealth Through Smart Asset Allocation

The question isn’t whether gold investment, real estate investment, or equity investment is superior—it’s about understanding how these asset classes work together to create robust wealth building strategies. Each investment type contributes unique benefits to portfolio performance, from stability and hedging to growth and income generation.

Successful investors recognize that portfolio diversification across multiple asset classes reduces overall risk while maintaining growth potential.

By understanding the strengths and limitations of gold investment, real estate investment, and equity investment, you can construct an investment strategy that builds wealth smarter and more sustainably.

Looking to build a portfolio that balances growth, stability, and security? With Fundscart, you can automate investments in equities, mutual funds, and gold seamlessly—helping you grow wealth strategically through professional asset allocation and portfolio diversification tools designed for modern wealth creation.